Yee manages Huang real estate, a partnership in which she is also a partner. She receives 40% of all partnership income before guaranteed payments, but no less than $80,000 per year. In the current year, the partnership reports $100,000 in ordinary income. What is Yee's distributive share and her guaranteed payment?

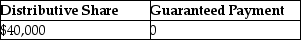

A)

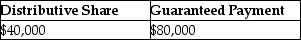

B)

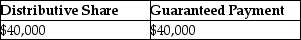

C)

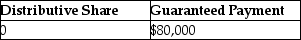

D)

Correct Answer:

Verified

Q14: Dan purchases a 25% interest in the

Q26: Bob contributes cash of $40,000 and Carol

Q38: Jane contributes land with an FMV of

Q63: Brent is a limited partner in BC

Q65: Nicholas, a 40% partner in Nedeau Partnership,

Q82: David purchased a 10% capital and profits

Q89: Identify which of the following statements is

Q100: When computing the partnership's ordinary income, a

Q104: When determining the guaranteed payment, which of

Q116: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents