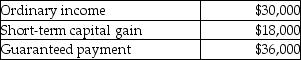

Brent is a general partner in BC Partnership. His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

A) $84,000

B) $66,000

C) $48,000

D) $36,000

Correct Answer:

Verified

Q23: Jane contributes land with an FMV of

Q27: Kay and Larry each contribute property to

Q38: Jane contributes land with an FMV of

Q77: Yee manages Huang real estate, a partnership

Q82: David purchased a 10% capital and profits

Q97: Jangyoun sells investment land having a $30,000

Q100: When computing the partnership's ordinary income, a

Q103: Henry has a 30% interest in the

Q106: In January of this year, Arkeva, a

Q116: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents