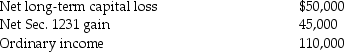

Tracy has a 25% profit interest and a 20% loss interest in the Dupont Partnership. The Dupont Partnership reports the following income and loss items for the current year:

What is Tracy's distributive share?

What is Tracy's distributive share?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: When the PDQ Partnership formed, it knew

Q53: Dinia has agreed to provide services valued

Q54: Jason, a lawyer, provided legal services for

Q74: What is included in partnership taxable income?

Q83: Jerry has a 10% interest in the

Q87: At the beginning of the current year,

Q95: Samantha works 40 hours a week as

Q99: The WE Partnership reports the following items

Q101: What is the tax impact of guaranteed

Q110: Bud has devoted his life to his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents