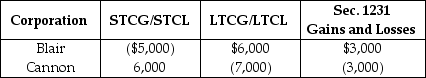

Blair and Cannon Corporations are members of an affiliated group. No prior net Sec. 1231 losses have been reported by any group member. The two corporations report consolidated ordinary income of $100,000 and gains and losses from property transactions as follows.  Which of the following statements is correct?

Which of the following statements is correct?

A) The consolidated group reports a net short-term capital gain of $1,000.

B) Blair Corporation's separate return reports a $4,000 net long-term capital gain.

C) Cannon Corporation's separate return reports a $1,000 net long-term capital loss.

D) All three of the above are correct.

Correct Answer:

Verified

Q3: What types of corporations are not includible

Q20: What issues determine whether an affiliated group

Q43: Gee Corporation purchased land from an unrelated

Q60: Identify which of the following statements is

Q64: Jason and Jon Corporations are members of

Q71: Identify which of the following statements is

Q73: Boxcar Corporation and Sidecar Corporation, an affiliated

Q76: Last year, Trix Corporation acquired 100% of

Q79: Roland, Shedrick, and Tyrone Corporations formed an

Q83: An affiliated group elects the use of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents