Broom Corporation transfers assets with an adjusted basis of $300,000 and an FMV of $400,000 to Docker Corporation in exchange for $400,000 of Docker Corporation stock as part of a tax-free reorganization. The Docker stock had been purchased from its shareholders one year earlier for $350,000. How much gain do Broom and Docker Corporations recognize on the asset transfer?

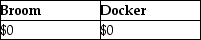

A)

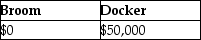

B)

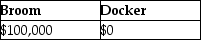

C)

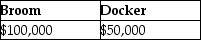

D)

Correct Answer:

Verified

Q10: Jersey Corporation purchased 50% of Target Corporation's

Q13: In a Sec.338 election,the target corporation

A)will no

Q13: Melon Corporation makes its first purchase of

Q32: Paper Corporation adopts a plan of reorganization

Q39: Identify which of the following statements is

Q42: Acme Corporation acquires Fisher Corporation's assets in

Q43: Identify which of the following statements is

Q44: American Corporation acquires the noncash assets of

Q66: Identify which of the following statements is

Q74: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents