Bob exchanges 4000 shares of Beetle Corporation stock that he had purchased for $800,000 for 6000 shares of Butterfly Corporation common stock with a fair market value of $1,000,000. What is Bob's recognized gain on the exchange and his basis in the Butterfly stock?

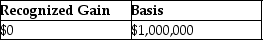

A)

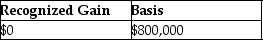

B)

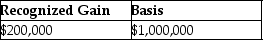

C)

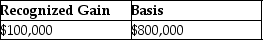

D)

Correct Answer:

Verified

Q10: Jersey Corporation purchased 50% of Target Corporation's

Q11: A stock acquisition that is not treated

Q13: Melon Corporation makes its first purchase of

Q14: Identify which of the following statements is

Q19: Which of the following definitions of Sec.

Q23: Identify which of the following statements is

Q34: Identify which of the following statements is

Q39: Identify which of the following statements is

Q42: Acme Corporation acquires Fisher Corporation's assets in

Q60: Acme Corporation acquires Fisher Corporation's assets in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents