Cowboy Corporation owns 90% of the single class of stock in Doggie Corporation. The other 10% is owned by Miguel, an individual. Cowboy's basis in its Doggie Corporation stock is $100,000 and Miguel's basis is $50,000. Doggie Corporation distributes property having an adjusted basis of $150,000 and an FMV of $500,000 to Cowboy Corporation, and $60,000 of money to Miguel as a liquidating distribution. Doggie and Cowboy Corporations must recognize gain of:

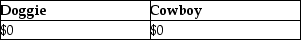

A)

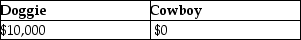

B)

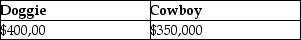

C)

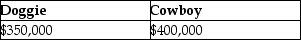

D)

Correct Answer:

Verified

Q2: Identify which of the following statements is

Q6: Property received in a corporate liquidation by

Q14: Identify which of the following statements is

Q15: Robot Corporation is liquidated,with Marty receiving property

Q21: Identify which of the following statements is

Q25: Identify which of the following statements is

Q31: The stock of Cooper Corporation is 70%

Q32: Last year, Toby made a capital contribution

Q38: Under a plan of complete liquidation, Coast

Q56: Parent Corporation for ten years has owned

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents