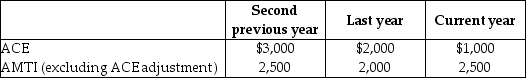

Drury Corporation, which was organized three years ago, reports the following adjusted current earnings (ACE) and preadjustment alternative minimum taxable income (AMTI) amounts.

What is the ACE adjustment to increase (or decrease) taxable income to arrive at AMTI for the second previous year?

What is the ACE adjustment to increase (or decrease) taxable income to arrive at AMTI for the second previous year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Barker Corporation,a personal service company,has $200,000 of

Q25: Define personal holding company income.

Q30: What is the effect of the two-pronged

Q34: Barker Corporation,a personal service company,has $200,000 of

Q35: Door Corporation's alternative minimum taxable income before

Q42: The courts and the Treasury Regulations have

Q52: Identify which of the following statements is

Q56: A manufacturing corporation has accumulated E&P of

Q58: When computing the accumulated earnings tax, which

Q81: Eagle Corporation, a personal holding company, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents