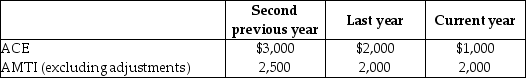

Drury Corporation, which was organized three years ago, reports the following adjusted current earnings (ACE) and preadjustment alternative minimum taxable income (AMTI) amounts.

What is the ACE adjustment to increase (or decrease) taxable income to arrive at AMTI for the current year?

What is the ACE adjustment to increase (or decrease) taxable income to arrive at AMTI for the current year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Arnold Corporation reports taxable income of $250,000,tax

Q41: Which of the following is not permitted

Q43: Flower Corporation,a C corporation but not a

Q50: In determining accumulated taxable income for the

Q51: When using the Bardahl formula, an increase

Q53: Identify which of the following statements is

Q54: When computing the accumulated earnings tax, the

Q55: Identify which of the following statements is

Q57: In the current year,Sun Corporation's federal income

Q80: The accumulated earnings tax is imposed at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents