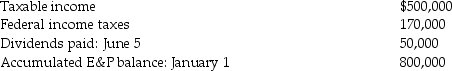

Lawrence Corporation reports the following results during the current year:

No dividends were paid in the throwback period. A long-term capital gain of $50,000 is included in taxable income. The statutory accumulated earnings tax exemption has been used up in prior years. An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business. What is Lawrence Corporation's accumulated earnings tax liability?

No dividends were paid in the throwback period. A long-term capital gain of $50,000 is included in taxable income. The statutory accumulated earnings tax exemption has been used up in prior years. An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business. What is Lawrence Corporation's accumulated earnings tax liability?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: What is a personal holding company?

Q45: Explain the carryover provisions of the minimum

Q52: What are the four general rules that

Q56: How is alternative minimum taxable income computed?

Q56: How is the accumulated earnings tax liability

Q89: Raptor Corporation is a PHC for 2009

Q90: Khuns Corporation, a personal holding company, reports

Q91: The following information is reported by Acme

Q91: Smartmoney,Inc.was formed by three wealthy dentists to

Q99: Mullins Corporation is classified as a PHC

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents