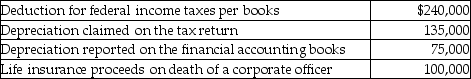

Bishop Corporation reports taxable income of $700,000 on its tax return. Given the following information from the corporation's records, determine Bishop's net income per its financial accounting records.

A) $520,000

B) $620,000

C) $660,000

D) $560,000

Correct Answer:

Verified

Q62: Lass Corporation reports a $25,000 net capital

Q63: Winter Corporation's taxable income is $500,000. In

Q65: Dreyfuss Corporation reports the following items:

Q72: Sun and Moon Corporations each have only

Q84: Identify which of the following statements is

Q85: Andy owns 20% of North Corporation and

Q86: Joker Corporation owns 80% of Klue Corporation.

Q91: Which of the following is not subject

Q96: Davis Corporation,a manufacturer,has taxable income of $150,000.Davis's

Q97: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents