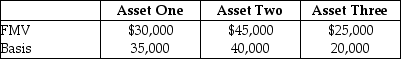

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec. 351.  Max's recognized gain is

Max's recognized gain is

A) $3,000.

B) $5,000.

C) $7,000.

D) $10,000.

Correct Answer:

Verified

Q43: Identify which of the following statements is

Q51: The transferor's holding period for any stock

Q51: Carmen and Marc form Apple Corporation.Carmen transfers

Q57: Identify which of the following statements is

Q59: Henry transfers property with an adjusted basis

Q67: Beth transfers an asset having an FMV

Q71: Chris transfers land with a basis of

Q72: Chris transfers land with a basis of

Q77: The transferee corporation's basis in property received

Q78: The transferor's holding period for any boot

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents