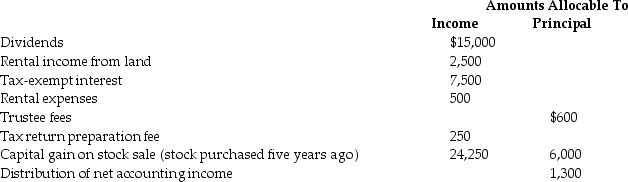

The Tucker Trust was established six years ago. The trust is required to distribute all of the trust income at least annually to Betty for life. Capital gains are credited to principal. The current year results of the trust are as follows:

Payment of estimated taxes

Payment of estimated taxes

Compute (a) distributable net income (DNI), (b) the distribution deduction, (c) trust taxable income, and (d) Betty's reportable income and its classification. Charge all of the deductible expenses against rent income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Briefly discuss some of the reasons for

Q51: Ebony Trust was established two years ago

Q65: A trust has distributable net income (DNI)of

Q78: Describe the tier system for trust beneficiaries.

Q80: A trust document does not define income

Q81: Marge died on August 24 of the

Q82: A simple trust has the following results:

Q84: A trust reports the following results:

Q87: What is the basis of inherited IRD

Q88: A trust reports the following results:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents