The Williams Trust was established six years ago. The trust document allows the trustee to distribute income in its discretion to beneficiaries Carol and Karen for the next 15 years. The trust will then be terminated and the trust assets will be divided equally between Carol and Karen. Capital gains are part of principal.

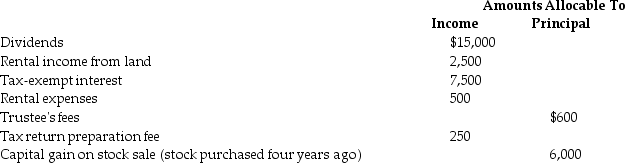

The current year income and expenses of the trust are reported below.

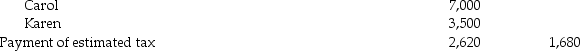

Distribution of net accounting income to:

Distribution of net accounting income to:

Compute (a) distributable net income (DNI), (b) distribution deduction, (c) trust taxable income, and (d) Carol's and Karen's reportable income and its classification. Charge all of the deductible expenses against the rental income.

Compute (a) distributable net income (DNI), (b) distribution deduction, (c) trust taxable income, and (d) Carol's and Karen's reportable income and its classification. Charge all of the deductible expenses against the rental income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Explain to a client the significance of

Q27: Outline the classification of principal and income

Q43: A trust must distribute all of its

Q60: Explain the three functions of distributable net

Q71: In the year of termination, a trust

Q79: Sukdev Basi funded an irrevocable simple trust

Q85: Ed Camby sold an apartment building in

Q98: Describe the double taxation of income in

Q103: What is the benefit of the 65-day

Q105: For the first five months of its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents