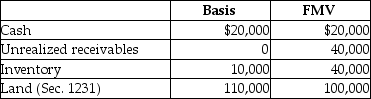

Kenya sells her 20% partnership interest having a $28,000 basis to Ebony for $40,000 cash. At the time of the sale, the partnership has no liabilities and its assets are as follows:  Kenya and Ebony have no agreement concerning the allocation of the sales price. Ordinary income recognized by Kenya as a result of the sale is

Kenya and Ebony have no agreement concerning the allocation of the sales price. Ordinary income recognized by Kenya as a result of the sale is

A) $6,000.

B) $12,000.

C) $14,000.

D) $16,000.

Correct Answer:

Verified

Q18: The total bases of all distributed property

Q39: The XYZ Partnership owns the following assets

Q47: Derrick's interest in the DEF Partnership is

Q48: Ten years ago, Latesha acquired a one-third

Q55: Ted King's basis for his interest in

Q64: Identify which of the following statements is

Q65: A partnership terminates for tax purposes

A)only when

Q70: If a partnership chooses to form an

Q93: Identify which of the following statements is

Q100: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents