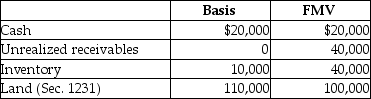

Steve sells his 20% partnership interest having a $28,000 basis to Nancy for $40,000 cash. At the time of the sale, the partnership has no liabilities and its assets are as follows:  The receivables and inventory are Sec. 751 assets. There is no agreement concerning the allocation of the sales price. Steve must recognize

The receivables and inventory are Sec. 751 assets. There is no agreement concerning the allocation of the sales price. Steve must recognize

A) no gain or loss.

B) $12,000 ordinary income.

C) $12,000 capital gain.

D) $14,000 ordinary income and $2,000 capital loss.

Correct Answer:

Verified

Q45: Identify which of the following statements is

Q55: Before receiving a liquidating distribution, Kathy's basis

Q59: Identify which of the following statements is

Q64: Identify which of the following statements is

Q69: For tax purposes, a partner who receives

Q72: Identify which of the following statements is

Q77: If a partner dies, his or her

Q86: A partnership terminates for federal income tax

Q88: Sally is a calendar-year taxpayer who owns

Q96: Marc is a calendar-year taxpayer who owns

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents