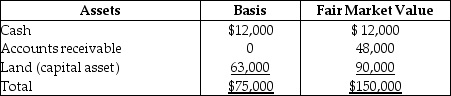

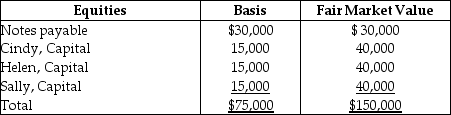

The CHS Partnership's balance sheet presented below is prepared on a cash basis at September 30 of the current year.

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is $25,000. What gain/loss should she report for tax purposes?

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is $25,000. What gain/loss should she report for tax purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: On November 30, Teri received a current

Q26: The TK Partnership has two assets: $20,000

Q60: Adnan had an adjusted basis of $11,000

Q72: The Tandy Partnership owns the following assets

Q82: Han purchases a 25% interest in the

Q83: Identify which of the following statements is

Q84: The AB, BC, and CD Partnerships merge

Q85: When must a partnership make mandatory basis

Q93: Which of the following is valid reason

Q95: Patrick purchases a one-third interest in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents