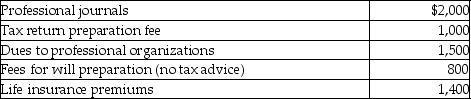

West's adjusted gross income was $90,000.During the current year he incurred and paid the following:  None of the expenses were reimbursed.Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

None of the expenses were reimbursed.Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

A) $2,700

B) $4,500

C) $3,500

D) $5,300

Correct Answer:

Verified

Q1: Deferred compensation refers to methods of compensating

Q6: Allison,who is single,incurred $4,000 for unreimbursed employee

Q10: If the purpose of a trip is

Q11: In which of the following situations is

Q14: Incremental expenses of an additional night's lodging

Q16: Which of the following statements regarding independent

Q16: The deduction for unreimbursed transportation expenses for

Q17: Gambling losses are miscellaneous itemized deductions subject

Q17: An employer-employee relationship exists where the employer

Q20: If an individual is self-employed,business-related expenses are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents