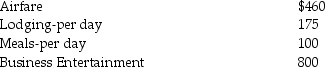

Richard traveled from New Orleans to New York for both business and vacation.He spent 4 days conducting business and some days vacationing.He incurred the following expenses:  What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

Correct Answer:

Verified

Q2: Unreimbursed employee business expenses are deductions for

Q17: An employer-employee relationship exists where the employer

Q19: Travel expenses related to temporary work assignments

Q19: Jason,who lives in New Jersey,owns several apartment

Q21: Taxpayers may use the standard mileage rate

Q24: What factors are considered in determining whether

Q33: Commuting to and from a job location

Q33: Ron is a university professor who accepts

Q34: If the standard mileage rate is used

Q36: Gwen traveled to New York City on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents