Austin incurs $3,600 for business meals while traveling for his employer,Tex,Inc.Austin is reimbursed in full by Tex pursuant to an accountable plan.What amounts can Austin and Tex deduct?

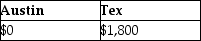

A)

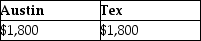

B)

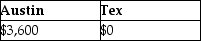

C)

D)

Correct Answer:

Verified

Q21: All of the following are allowed a

Q27: Chuck, who is self- employed, is scheduled

Q36: Rajiv,a self-employed consultant,drove his auto 20,000 miles

Q38: Jordan,an employee,drove his auto 20,000 miles this

Q40: David acquired an automobile for $30,000 for

Q43: If an employee incurs business-related entertainment expenses

Q44: A gift from an employee to his

Q45: Shane,an employee,makes the following gifts,none of which

Q59: An accountant takes her client to a

Q60: Sarah incurred employee business expenses of $5,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents