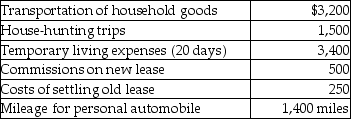

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

A) $3,522

B) $6,600

C) $9,172

D) $8,422

Correct Answer:

Verified

Q50: Fiona is about to graduate college with

Q51: Under a qualified pension plan,the employer's deduction

Q56: Pat is a sales representative for a

Q56: Gina is an instructor at State University

Q64: Explain when educational expenses are deductible for

Q67: Educational expenses incurred by a CPA for

Q72: Edward incurs the following moving expenses:

Q73: Deductible moving expenses include the cost of

Q75: All of the following may deduct education

Q77: Ellie,a CPA,incurred the following deductible education expenses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents