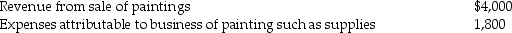

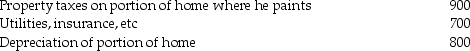

Dighi,an artist,uses a room in his home (250 square feet)as a studio exclusively to paint.The studio meets the requirements for a home office deduction.(Painting is considered his trade or business.)The following information appears in Dighi's records:  Expenses related to home office:

Expenses related to home office:  (a)What is the amount of Dighi's home office deduction if he is self-employed?

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(b)If some amount is not allowed under the tax law,how is the disallowed amount treated?

(c)Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill.How much of a home office deduction,if any,will he be allowed?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: A sole proprietor will not be allowed

Q45: Alex is a self-employed dentist who operates

Q47: Charles is a self-employed CPA who maintains

Q49: A qualified pension plan requires that employer-provided

Q72: When are home- office expenses deductible?

Q75: SIMPLE retirement plans allow a higher level

Q80: All taxpayers are allowed to contribute funds

Q94: The following individuals maintained offices in their

Q102: Martin Corporation granted a nonqualified stock option

Q107: The maximum tax deductible contribution to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents