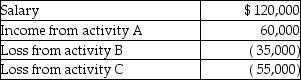

Joy reports the following income and loss:  Activities A,B,and C are all passive activities. Based on this information,Joy has

Activities A,B,and C are all passive activities. Based on this information,Joy has

A) adjusted gross income of $90,000.

B) salary of $120,000 and deductible net losses of $30,000.

C) salary of $120,000 and net passive losses of $30,000 that will be carried over.

D) salary of $120,000,passive income of $60,000,and passive loss carryovers of $90,000.

Correct Answer:

Verified

Q9: All of the following are true of

Q34: Amy,a single individual and sole shareholder of

Q35: When applying the limitations of the passive

Q36: Material participation by a taxpayer in a

Q36: Sarah had a $30,000 loss on Section

Q43: Nancy reports the following income and loss

Q43: Shaunda has AGI of $90,000 and owns

Q44: Justin has AGI of $110,000 before considering

Q58: Lewis died during the current year.Lewis owned

Q76: Aretha has AGI of less than $100,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents