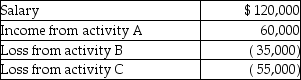

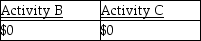

Joy reports the following income and loss:  Activities A,B,and C are all passive activities. Based on this information,Joy has the following suspended losses:

Activities A,B,and C are all passive activities. Based on this information,Joy has the following suspended losses:

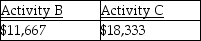

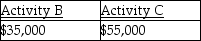

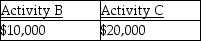

A)

B)

C)

D)

Correct Answer:

Verified

Q37: During the year,Mark reports $90,000 of active

Q41: Tom and Shawn own all of the

Q42: Mara owns an activity with suspended passive

Q43: Shaunda has AGI of $90,000 and owns

Q46: A taxpayer's rental activities will be considered

Q47: Jana reports the following income and loss:

Q50: Joseph has AGI of $170,000 before considering

Q52: Jeff owned one passive activity.Jeff sold the

Q56: Which of the following is not generally

Q57: Jorge owns activity X which produced a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents