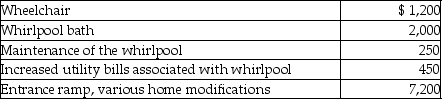

Alan,who is a security officer,is shot while on the job.As a result,Alan suffers from a chronic leg injury and must use a wheelchair and undergo therapy to regain and retain strength.Alan's physician recommends that he install a whirlpool bath in his home for therapy.During the year,Alan makes the following expenditures:  A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

A) $6,000.

B) $10,100.

C) $7,000.

D) $7,700.

Correct Answer:

Verified

Q9: Leo spent $6,600 to construct an entrance

Q24: Self-employed individuals may deduct the full self-employment

Q29: A personal property tax based on the

Q31: The following taxes are deductible as itemized

Q34: A review of the 2015 tax file

Q35: Mr.and Mrs.Gere,who are filing a joint return,have

Q39: Foreign real property taxes and foreign income

Q266: Explain under what circumstances meals and lodging

Q270: Discuss the timing of the allowable medical

Q280: Explain when the cost of living in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents