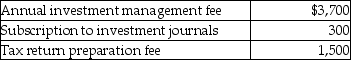

Nina includes the following expenses in her miscellaneous itemized deductions before application of the 2% of AGI floor:  Nina's AGI is $100,000.How much of the above-noted expenses will reduce her net investment income?

Nina's AGI is $100,000.How much of the above-noted expenses will reduce her net investment income?

A) $4,000

B) $5,500

C) $3,000

D) $3,500

Correct Answer:

Verified

Q61: Dana paid $13,000 of investment interest expense

Q64: Claudia refinances her home mortgage on June

Q68: On July 31 of the current year,Marjorie

Q69: Teri pays the following interest expenses during

Q74: Riva borrows $10,000 that she intends to

Q75: Faye earns $100,000 of AGI,including $90,000 of

Q78: Which of the following is deductible as

Q78: Christopher,a cash basis taxpayer,borrows $1,000 from ABC

Q80: Takesha paid $13,000 of investment interest expense

Q98: Marcia,who is single,finished graduate school this year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents