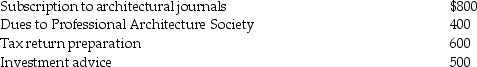

Wang,a licensed architect employed by Skye Architects,incurred the following unreimbursed expenses this year:  Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

A) $0

B) $1,900

C) $800

D) $1,500

Correct Answer:

Verified

Q102: What is the result if a taxpayer

Q103: A taxpayer can deduct a reasonable amount

Q104: Christa has made a $25,000 pledge to

Q106: Tasneem,a single taxpayer has paid the following

Q109: Grace has AGI of $60,000 in 2014

Q115: Ivan's AGI is about $50,000 this year,and

Q347: Jorge contributes $35,000 to his church and

Q349: May an individual deduct a charitable contribution

Q352: What is the treatment of charitable contributions

Q357: Explain how tax planning may allow a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents