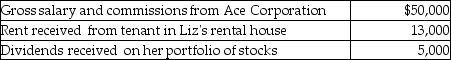

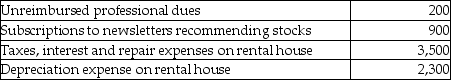

Liz,who is single,lives in a single family home and owns a second single family home that she rented for the entire year at a fair rental rate.Liz had the following items of income and expense during the current year. Income:  Expenses:

Expenses:  What is her adjusted gross income for the year?

What is her adjusted gross income for the year?

A) $52,700

B) $61,100

C) $62,200

D) $68,000

Correct Answer:

Verified

Q10: A deduction will be allowed for an

Q14: Expenses incurred in connection with conducting a

Q15: Assume Congress wishes to encourage healthy eating

Q16: Expenses incurred in a trade or business

Q19: A change to adjusted gross income cannot

Q25: Laura,the controlling shareholder and an employee of

Q26: An expense is considered necessary if it

Q32: Pamela was an officer in Green Restaurant

Q40: Desi Corporation incurs $5,000 in travel,market surveys,and

Q401: List those criteria necessary for an expenditure

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents