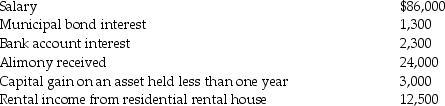

During the current year,Donna,a single taxpayer,reports the following items income of income and expenses:

Income:  Expenses/losses:

Expenses/losses:  Compute Donna's taxable income.(Show all calculations in good form.)

Compute Donna's taxable income.(Show all calculations in good form.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Adjusted gross income (AGI)is the basis for

Q5: Charles is a single person,age 35,with no

Q10: Deductions for adjusted gross income include all

Q11: According to the tax formula,individuals can deduct

Q12: Deductions for AGI may be located

A)on the

Q13: A single taxpayer has adjusted gross income

Q13: Itemized deductions are deductions for AGI.

Q13: In 2015,Sean,who is single and age 44,received

Q15: Self-employed individuals may claim,as a deduction for

Q15: On Form 1040,deductions for adjusted gross income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents