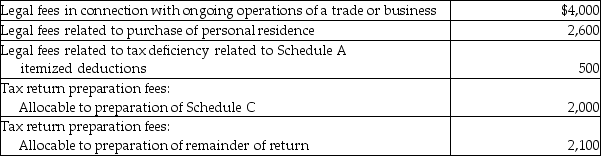

Maria pays the following legal and accounting fees during the year:  What is the total amount of her for AGI deduction for these fees?

What is the total amount of her for AGI deduction for these fees?

A) $4,000

B) $6,000

C) $8,100

D) $11,200

Correct Answer:

Verified

Q7: Generally,expenses incurred in an investment activity other

Q14: Fees paid to prepare a taxpayer's Schedule

Q21: Which of the following is not required

Q23: Mark and his brother,Rick,each own farms.Rick is

Q25: Laura,the controlling shareholder and an employee of

Q26: During the current year,Lucy,who has a sole

Q27: To be tax deductible,an expense must be

Q33: Taxpayers may deduct legal fees incurred in

Q40: Desi Corporation incurs $5,000 in travel,market surveys,and

Q40: Various criteria will disqualify the deduction of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents