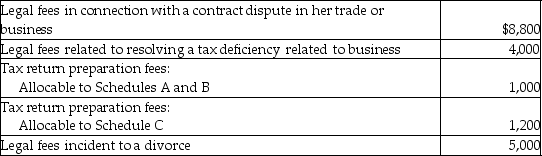

Leigh pays the following legal and accounting fees during the year:  What is the total amount of her for AGI deduction for these fees?

What is the total amount of her for AGI deduction for these fees?

A) $10,800

B) $14,000

C) $15,000

D) $20,000

Correct Answer:

Verified

Q7: Generally,expenses incurred in an investment activity other

Q14: Fees paid to prepare a taxpayer's Schedule

Q21: Which of the following is not required

Q25: During the current year,Martin purchases undeveloped land

Q28: In order for an expense to be

Q33: Taxpayers may deduct legal fees incurred in

Q39: Carole owns 75% of Pet Foods,Inc.As CEO,Carole

Q40: Various criteria will disqualify the deduction of

Q391: Discuss why the distinction between deductions for

Q405: Ben is a well- known professional football

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents