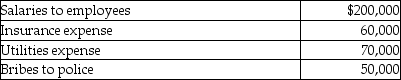

Troy incurs the following expenses in his business,an illegal gambling establishment:  His deductible expenses are

His deductible expenses are

A) $0.

B) $200,000.

C) $330,000.

D) $380,000.

Correct Answer:

Verified

Q27: Interest expense on debt incurred to purchase

Q45: Capital expenditures add to the value,substantially prolong

Q49: Taxpayers may deduct lobbying expenses incurred to

Q51: Pat,an insurance executive,contributed $1,000,000 to the reelection

Q55: During 2015 and 2016,Danny pays property taxes

Q57: Emeril borrows $340,000 to finance taxable and

Q58: Jimmy owns a trucking business.During the current

Q411: Mickey has a rare blood type and

Q434: Super Development Company purchased land in the

Q437: During the current year, Charlene borrows $10,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents