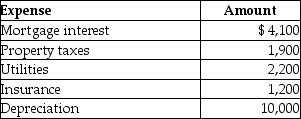

Abby owns a condominium in the Great Smokey Mountains.During the year,Abby uses the condo a total of 21 days.The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500.Abby incurs the following expenses:  Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

A) $ 5,074.

B) $ 8,515.

C) $ 7,900.

D) $10,000.

Correct Answer:

Verified

Q87: The term "principal place of business" includes

Q105: Nikki is a single taxpayer who owns

Q108: The Super Bowl is played in Tasha's

Q119: Kyle drives a race car in his

Q120: For the years 2011 through 2015 (inclusive)Mary,a

Q125: Anita has decided to sell a parcel

Q126: Brent must substantiate his travel and entertainment

Q127: Tess has started a new part-time business.She

Q481: Diane, a successful accountant with an annual

Q483: During the current year, Jack personally uses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents