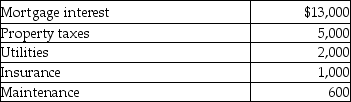

Ola owns a cottage at the beach.She and her family use the property for 30 days during the summer season and rent it to unrelated parties for 60 days.The rental receipts amount to $8,000.Total costs of operating the property are as follows:  In addition,potential depreciation expense is $9,000.

In addition,potential depreciation expense is $9,000.

a.Is the cottage subject to the vacation home rental limitations of IRC Sec.280A?

b.How much of expenses can Ola deduct?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Gabby owns and operates a part-time art

Q127: Tess has started a new part-time business.She

Q128: Vanessa owns a houseboat on Lake Las

Q132: Lindsey Forbes,a detective who is single,operates a

Q135: During the current year,Paul,a single taxpayer,reported the

Q136: Margaret,a single taxpayer,operates a small pottery activity

Q137: In 2015 the IRS audits a company's

Q138: Mackensie owns a condominium in the Rocky

Q486: Explain the rules for determining whether a

Q497: Discuss tax planning considerations which a taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents