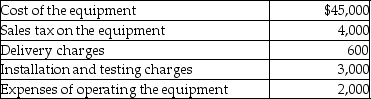

During the current year,Tony purchased new car wash equipment for use in his service station business.Tony's costs in connection with the new equipment this year were as follows:  What is Tony's basis in the car wash equipment?

What is Tony's basis in the car wash equipment?

A) $49,000

B) $49,600

C) $52,600

D) $54,600

Correct Answer:

Verified

Q27: For purposes of calculating depreciation,property converted from

Q27: Empire Corporation purchased an office building for

Q28: Allison buys equipment and pays cash of

Q31: With regard to taxable gifts after 1976,no

Q33: Unless the alternate valuation date is elected,the

Q33: Capitalization of interest is required if debt

Q37: Kathleen received land as a gift from

Q40: If the stock received as a nontaxable

Q50: Douglas and Julie are a married couple

Q54: Billy and Sue are married and live

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents