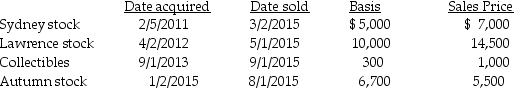

Chen had the following capital asset transactions during 2015:  What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Candice owns a mutual fund that reinvests

Q101: Melanie,a single taxpayer,has AGI of $220,000 which

Q102: Olivia,a single taxpayer,has AGI of $280,000 which

Q106: Unlike an individual taxpayer,the corporate taxpayer does

Q107: Niral is single and provides you with

Q107: Amanda,whose tax rate is 33%,has NSTCL of

Q110: Jade is a single taxpayer in the

Q110: Corporate taxpayers may offset capital losses only

Q115: Stock purchased on December 15,2014,which becomes worthless

Q118: Abra Corporation generated $100,000 of taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents