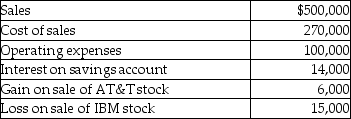

In the current year,ABC Corporation had the following items of income,expense,gains,and losses:  What is taxable income for the year?

What is taxable income for the year?

A) $135,000

B) $141,000

C) $144,000

D) $150,000

Correct Answer:

Verified

Q103: Purchase of a bond at a significant

Q105: Gain on sale of a patent by

Q107: Amanda,whose tax rate is 33%,has NSTCL of

Q115: Stock purchased on December 15,2014,which becomes worthless

Q117: Max sold the following capital assets this

Q121: On July 25,2014,Marilyn gives stock with a

Q124: Everest Inc.is a corporation in the 35%

Q124: Because of the locked-in effect,high capital gains

Q124: Rita died on January 1,2015 owning an

Q643: What type of property should be transferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents