Rita,who has marginal tax rate of 39.6%,is planning to make a gift to her grandson who is in the lowest tax bracket.Which of the following holdings of stock would be the most tax advantageous gift from Rita's perspective?

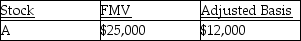

A)

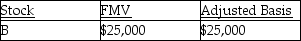

B)

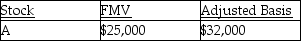

C)

D) For income tax purposes,Rita will be indifferent as to choice of stock to gift.

Correct Answer:

Verified

Q107: On January 31 of the current year,Sophia

Q120: On January 31 of this year,Jennifer pays

Q127: How long must a capital asset be

Q133: A taxpayer owns 200 shares of stock

Q134: Adam purchased 1,000 shares of Airco Inc.common

Q134: If property received as a gift has

Q135: On July 25,2014,Karen gives stock with a

Q136: Rana purchases a 5%,$100,000 corporate bond at

Q141: A taxpayer reports capital gains and losses

Q653: What are arguments for and against preferential

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents