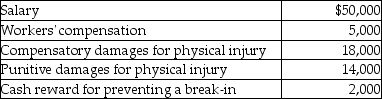

Joe Black,a police officer,was injured in the line of duty.He received the following during the current year:  What is the amount that is taxable?

What is the amount that is taxable?

A) $57,000

B) $66,000

C) $71,000

D) $84,000

Correct Answer:

Verified

Q73: Lindsay Corporation made the following payments to

Q74: Benefits covered by Section 132 which may

Q76: Sharisma suffered a serious stroke and was

Q79: All of the following fringe benefits paid

Q80: Which of the following item(s)must be included

Q81: Adam purchased stock in 2006 for $100,000.He

Q82: In September of 2015,Michelle sold shares of

Q84: Jan has been assigned to the Rome

Q85: Jamal,age 52,is a human resources manager for

Q96: Exter Company is experiencing financial difficulties.It has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents