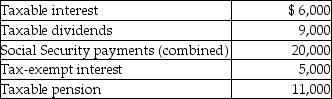

Mr.& Mrs.Bronson are both over 65 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

A) $0

B) $4,500

C) $10,000

D) $20,000

Correct Answer:

Verified

Q88: David,age 62,retires and receives $1,000 per month

Q91: Natasha,age 58,purchases an annuity for $40,000.Natasha will

Q96: Jonathon,age 50 and in good health,withdrew $6,000

Q104: Reva is a single taxpayer with a

Q105: While using a metal detector at the

Q107: Homer Corporation's office building was destroyed by

Q113: During 2014,Christiana's employer withheld $1,500 from her

Q121: Under the terms of a divorce agreement

Q129: Emma is the sole shareholder in Pacific

Q143: Adanya's marginal tax rate is 39.6% and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents