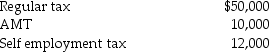

Beth and Jay project the following taxes for the current year:  How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: With respect to estimated tax payments for

Q122: If a taxpayer's AGI is greater than

Q123: Nonrefundable personal tax credits are allowed against

Q126: Discuss when Form 6251,Alternative Minimum Tax,must be

Q127: Assume a taxpayer determines that his total

Q127: Bob's income can vary widely from year-to-year

Q128: A taxpayer at risk for AMT should

Q1659: Describe the differences between the American Opportunity

Q1661: Discuss the tax planning techniques available to

Q1666: Discuss actions a taxpayer can take if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents