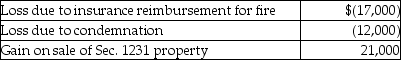

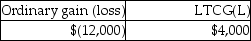

This year Jenna had the gains and losses noted below on property,plant and equipment used in her business.Each asset had been held longer than one year.Jenna has not previously disposed of any business assets.  Jenna will recognize

Jenna will recognize

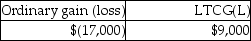

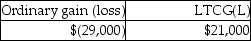

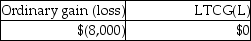

A)

B)

C)

D)

Correct Answer:

Verified

Q27: If the accumulated depreciation on business equipment

Q39: The purpose of Sec.1245 is to eliminate

Q43: Sec.1245 ordinary income recapture can apply to

Q44: With respect to residential rental property

A)80% or

Q50: For noncorporate taxpayers,depreciation recapture is not required

Q55: On June 1,2012,Buffalo Corporation purchased and placed

Q58: Section 1250 does not apply to assets

Q59: All of the following statements are true

Q69: A building used in a business for

Q75: With regard to noncorporate taxpayers,all of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents