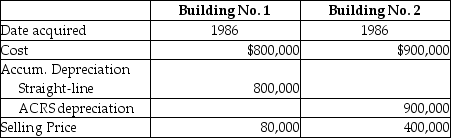

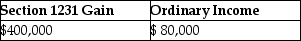

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for the first building and the accelerated method (ACRS) was used for the second building.Information about those buildings is presented below.  How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

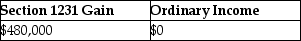

A)

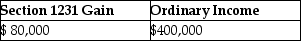

B)

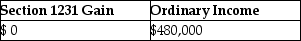

C)

D)

Correct Answer:

Verified

Q25: If realized gain from disposition of business

Q42: An unincorporated business sold two warehouses during

Q42: Sec.1245 can increase the amount of gain

Q44: The following are gains and losses recognized

Q46: Network Corporation purchased $200,000 of five-year equipment

Q48: The following gains and losses pertain to

Q48: During the current year,a corporation sells equipment

Q49: Sec.1245 applies to gains on the sale

Q57: If a taxpayer has gains on Sec.1231

Q59: During the current year,Hugo sells equipment for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents