This year,John purchased property from William by assuming an existing mortgage of $40,000 and agreed to pay an additional $60,000,plus interest,in the 3 years following the year of sale (i.e.$20,000 annual payments for three years,plus interest) .William had an adjusted basis of $44,000 in the building.What are the sales price and the contract price in this transaction?

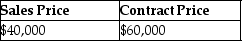

A)

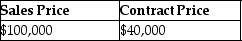

B)

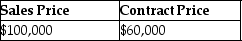

C)

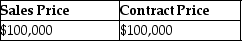

D)

Correct Answer:

Verified

Q61: Kevin sold property with an adjusted basis

Q64: On July 25 of this year,Raj sold

Q71: The installment sale method can be used

Q72: Which of the following conditions are required

Q72: An installment sale is best defined as

A)any

Q76: In year 1 a contractor agrees to

Q77: The installment sale method can be used

Q79: This year,Hamilton,a local manufacturer of off-shore drilling

Q80: Bergeron is a local manufacturer of off-shore

Q1948: Many taxpayers use the LIFO method of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents