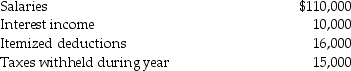

Brad and Angie had the following income and deductions during 2015:  Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q57: Flow-through entities do not have to file

Q60: In a limited liability partnership,a partner is

Q60: Martha is self-employed in 2015.Her business profits

Q68: Chris,a single taxpayer,had the following income and

Q69: Rocky and Charlie form RC Partnership as

Q75: Limited liability company members (owners)are responsible for

Q77: All of the following are classified as

Q79: What is an important aspect of a

Q2216: During the current tax year, Frank Corporation

Q2220: Doug and Frank form a partnership, D

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents