What are the correct monthly rates for calculating failure to file and failure to pay penalties?

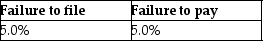

A)

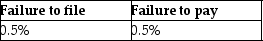

B)

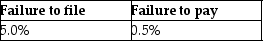

C)

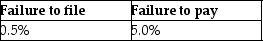

D)

Correct Answer:

Verified

Q61: Generally,tax legislation is introduced first in the

Q64: All of the following are executive (administrative)sources

Q82: Generally,the statute of limitations is three years

Q85: When returns are processed,they are scored to

Q94: Which is not a component of tax

Q95: Frederick failed to file his 2015 tax

Q100: Alan files his 2015 tax return on

Q2221: What does the statute of limitations mean?

Q2223: Describe the nondeductible penalties imposed upon taxpayers

Q2230: Describe the types of audits that the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents