Yee manages Huang real estate,a partnership in which she is also a partner.She receives 40% of all partnership income before guaranteed payments,but no less than $80,000 per year.In the current year,the partnership reports $100,000 in ordinary income.What is Yee's distributive share and her guaranteed payment?

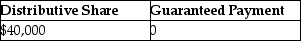

A)

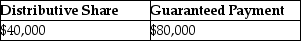

B)

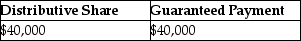

C)

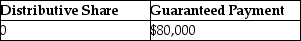

D)

Correct Answer:

Verified

Q101: What is the tax impact of guaranteed

Q103: Henry has a 30% interest in the

Q104: When determining the guaranteed payment, which of

Q105: Brent is a limited partner in BC

Q105: A partnership must file Form 1065 only

Q106: In January of this year, Arkeva, a

Q108: Nicholas,a 40% partner in Nedeau Partnership,gives one-half

Q110: Bud has devoted his life to his

Q111: Edward owns a 70% interest in the

Q114: Brent is a general partner in BC

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents