Broom Corporation transfers assets with an adjusted basis of $300,000 and an FMV of $400,000 to Docker Corporation in exchange for $400,000 of Docker Corporation stock as part of a tax-free reorganization.The Docker stock had been purchased from its shareholders one year earlier for $350,000.How much gain do Broom and Docker Corporations recognize on the asset transfer?

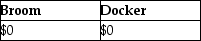

A)

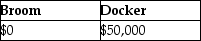

B)

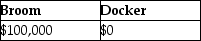

C)

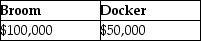

D)

Correct Answer:

Verified

Q4: In a taxable asset acquisition, the purchaser

Q6: Identify which of the following statements is

Q11: A stock acquisition that is not treated

Q16: Brown Corporation has assets with a $650,000

Q21: Parent Corporation purchases all of Target Corporation's

Q25: John Van Kirk owns all the stock

Q35: Why would an acquiring corporation want an

Q37: The acquiring corporation does not recognize gain

Q39: Identify which of the following statements is

Q43: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents