Homewood Corporation adopts a plan of liquidation on June 15 and shortly thereafter sells a parcel of land on which it realizes a $50,000 gain (excluding the effects of a $5,000 sales commission) .Homewood pays its legal counsel $2,000 to draft the plan of liquidation.The accountant fees for the liquidation are $1,000,which are also paid during the year.What is Homewood Corporation's realized gain on the sale of land and deductible liquidation expenses?

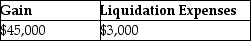

A)

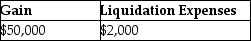

B)

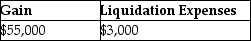

C)

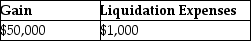

D)

Correct Answer:

Verified

Q83: What is the IRS's position regarding whether

Q84: For that following set of facts,what are

Q86: Santa Fe Corporation adopts a plan of

Q87: New York Corporation adopts a plan of

Q88: Why should a corporation that is 100%

Q89: Parent Corporation owns 70% of Sam Corporation's

Q92: When a liquidating corporation pays off an

Q95: Identify which of the following statements is

Q97: What are the tax consequences of a

Q100: What are the tax consequences to Parent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents