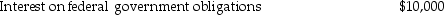

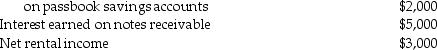

Investors Corporation has ten unrelated individual shareholders who each own 10% of the outstanding stock.For their tax year ended December 31 of this year,Investors' gross income includes:  Dividends from savings and loan associations

Dividends from savings and loan associations  No dividends are paid during the tax year or during the 2-1/2 month throwback period.Deductible administrative expenses total $4,000 for the year.Rental income has been reduced by $1,000 of depreciation and $2,000 of interest expense.What is Investors' undistributed personal holding company income?

No dividends are paid during the tax year or during the 2-1/2 month throwback period.Deductible administrative expenses total $4,000 for the year.Rental income has been reduced by $1,000 of depreciation and $2,000 of interest expense.What is Investors' undistributed personal holding company income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Identify which of the following statements is

Q19: A personal holding company cannot take a

Q30: Identify which of the following statements is

Q35: Door Corporation's alternative minimum taxable income before

Q38: Hydrangia Corporation reports the following results for

Q38: Which of the following statements regarding the

Q52: What are the four general rules that

Q55: Larry Corporation purchased a new precision casting

Q56: How is alternative minimum taxable income computed?

Q60: Rich Company sold equipment this year for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents